Employers on the Hook for Deferred Payroll Taxes

Late on Friday, the IRS finally issued guidance on President Trump’s Executive Order allowing certain payroll taxes to be deferred in late 2020:

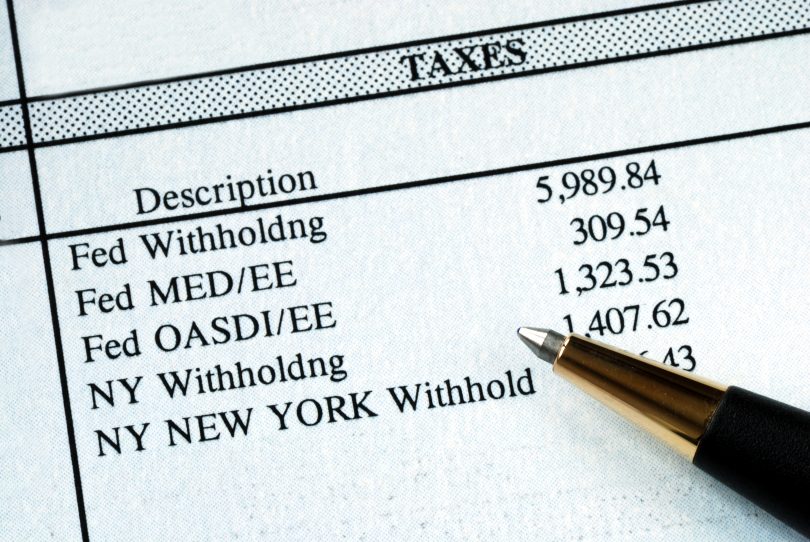

- Employers can defer withholding and depositing the employee portion only of Social Security.

- Applies to SS withheld on wages paid from Sept 1 though Dec 31, 2020.

- Applied only to employees whose gross wages are less than $4000 biweekly.

- Taxes are only postponed, not forgiven.

- Deferred taxes will be due beginning Jan 1, 2021 through April 30, 2021.

- Employers are responsible for collecting and paying back any deferred taxes.

- Employers can choose NOT to defer payroll taxes, even if their employees request the deferral.

The guidance issued makes it clear that unless Congress chooses to forgive deferred liabilities, employers are responsible for all held taxes, even for employees who may have left, been fired or are otherwise uncollectable. Although the IRS did say that employers can “make arrangements to otherwise collect the Applicable Taxes from the employee”, it did not provide any details on how that could be accomplished other than through payroll deductions.

BMC is recommending that NO employer choose to participate in this program. Deferred taxes are not a benefit to employees who will just have their tax burden doubled in the new year. And employers do not want to be in a position of owing their employee’s tax if it is uncollectable in six months.

We will continue to monitor this program and let you know if any criteria change or if our position or recommended action changes.